The strategy of RATEL is to encourage further investments and development of telecommunications markets by fostering competition, cost-effectiveness and efficiency in mobile communications, as well as to provide subscribers with fair and unbiased information about the quality of service in the mobile networks in the Republic of Serbia. Therefore, as of 2017, RATEL is carrying out the extensive benchmarking tests of the three mobile network operators: A1 Srbija, Telekom Srbija and Telenor. This is the fifth year in a row that RATEL performs nationwide benchmarking.

The purpose of Mobile Network Benchmarking is to compare in an objective fashion the quality of mobile network services by measuring Key Performance Indicators (KPIs) which represent user experience of services offered by all mobile network operators. The benchmarking measurements were conducted in September, October, and November 2021. In the first half of 2021, RATEL conducted a public international tender for Mobile Network Benchmarking activity and awarded a contract to a consortium comprised of CRONY, a Serbian company specialized in the representation of foreign companies in Serbia, and Systemics-PAB, a renowned services company from Poland.

Systemics-PAB is a well-recognized company offering benchmarking services to regulatory authorities and network operators worldwide. They provide solutions and services to measure, monitor and analyse the quality of mobile and fixed networks, with the aim to enhance the end-user experience. The experience Systemics-PAB gained in more than 15 years of working in this area, has enabled them to develop effective techniques and methodologies for conducting the benchmark activities, and all their tests, measurements and processes overall are ISO 9001 certified, which ensures impartiality and reliability of the results.

For the first time in the history of this project the rating and benchmarking of mobile services is done using ETSI methodology described in ETSI TR 103 559 Annex A document. This newly establish international standard allows objective assessment of Quality of Service and user experience for each mobile network operator.

Benchmarking measurements covered 55 cities, 15,000 km of Serbian roads and 1,800 km of railways. During the campaign, over 8000 voice calls and 8000 of every data service tests were performed for each mobile network operator across all technologies (2G, 3G, 4G). These measurements included:

The whole benchmarking campaign was divided into phases as presented in Figure 1.

Fig.1 Benchmarking campaign phases

In parallel with analysis and reporting, a dedicated portal was updated with new results to enable the broad public viewing of benchmarking results on RATEL’s web page. The portal was also improved with new features.

In 2020, the largest share in total revenues of 59 % in the Serbian electronic communications market, as in previous years, was achieved by providing mobile telephony services. (Source: An overview of the Telecom and Postal Services Market in the Republic of Serbia in 2020, RATEL).

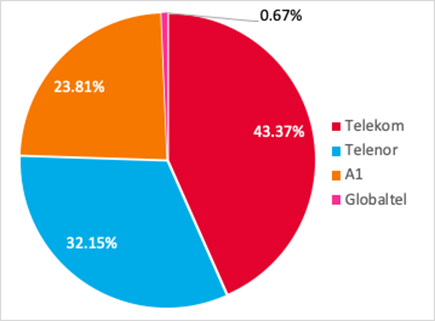

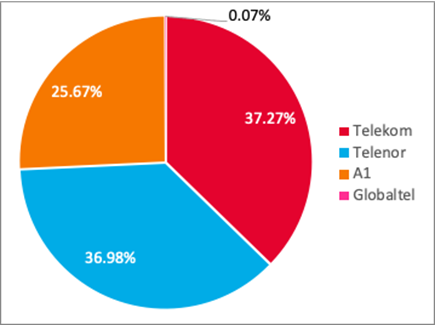

The mobile market in Serbia, in terms of number of subscribers, is divided among three mobile network operators (MNO) and one mobile virtual network operator (MVNO). Since MVNO Globaltel had around 0,07% mobile market revenue share and around 0,6% of mobile subscribers’ share in 2020, it was not included in the scope of the Benchmark activity. The mobile market share in Serbia in 2020 in terms of revenues generated by the operators are presented in Figure 3. Respective mobile subscribers’ shares of three MNOs in Q3 2021 are presented in Figure 2.

Fig. 2. Mobile subscribers

Source: Q3 2021 Market overview, RATEL

Fig. 3. Mobile market revenue share

Source: 2020 Market overview, RATEL

The number of mobile subscribers in Serbia is approximately 8.328 million, which corresponds to 120.71% of SIM penetration. The voice users generated more than 5.3 billion minutes in the second quarter of 2021. Close to 53% of the voice traffic was on-net traffic. 6.71 millions of subscribers were active mobile broadband subscribers generating over 149.3 million GB of data traffic in the Q2 2021.

Telekom Srbija - MTS is the mobile network operator with the greatest number of subscribers in Serbia. It was founded in 1997 and started to provide mobile communications service in 1998. Telekom Srbija operates its 4G network at 800 MHz, 1800 MHz and 2100MHz. Additionally, it operates a 3G network at 900 MHz and 2100 MHz and a 2G network at 900 MHz and 1800MHz. In 2019, Telekom Srbija started providing the VoLTE (Voice over LTE) service to its subscribers.

Telenor has been presented in Serbia since 2006, when they bought Mobi63, a former Mobtel that was founded in 1994. Since March 2018, Telenor is owned by PPF investment fund. Telenor operates its 4G network at 800 MHz and 1800 MHz, and partly at 2100 MHz. It operates its 3G network mainly at 900 MHz and 2100 MHz coverage, and its 2G network at 900 MHz and 1800 MHz. In 2020 Telenor started providing the VoLTE (Voice over LTE) service to its subscribers.

A1 Srbijawas established in 2006 and is part of Telekom Austria Group. Earlier this mobile operator used Vip mobile as brand name. A1 offers 4G network at 800 MHz,1800 MHz and 2100MHz, 3G network at 2100 MHz and at 900 MHz, and 2G network at 900 MHz and 1800 MHz. In 2019 A1 started providing the VoLTE (Voice over LTE) service to its subscribers.

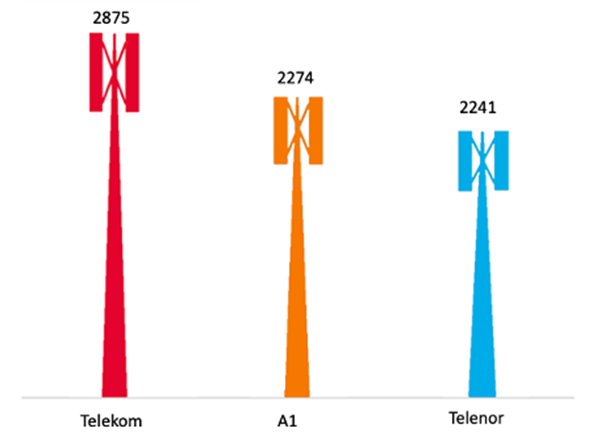

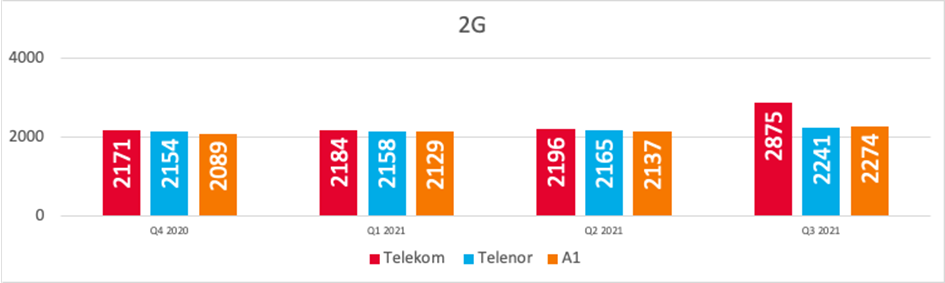

Telekom Srbija has the largest number of locations with active base stations in Q3 2021, as presented in Figure 4. (Source: RATEL data for Q3 2021, RATEL)

Fig. 4. Total number of locations with active base stations, per operator, Q3 2021

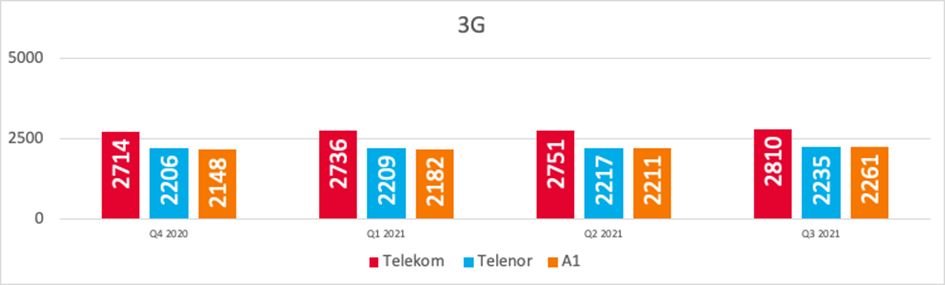

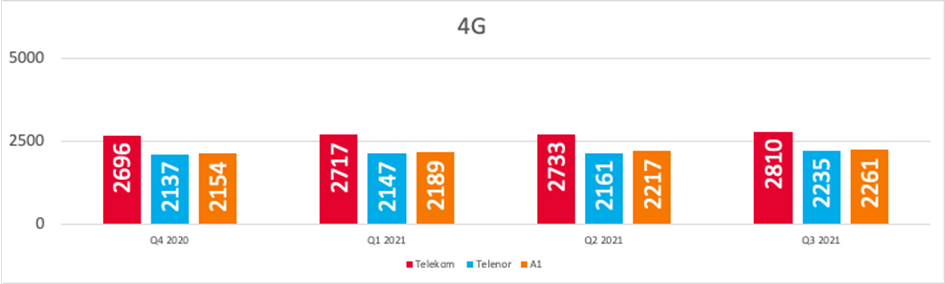

The total number of active base stations per mobile operator until Q3 2021, is presented in Figure 5.

Fig. 5. Total number of active base stations per technology and mobile operator until Q3 2021 (Source: RATEL data for Q4 2020, Q1 2021, Q2 2021, Q3 2021, RATEL)